Insurance Companies

The adoption and development of digital technology in the insurance industry is fundamentally simplifying processes, offering customers optimised services with an enhanced customer experience.

Digitization of processes at insurance companies is our strongest competency! We know the client’s needs and resolve their entire issue from online insurance arranging to B2B to claims settlement. With many years of know-how, we help you stay ahead of the curve, respond to changing customer expectations on time and reduce losses by speeding up the claims handling process.

PORTAL SOLUTIONS & CLIENT ZONES

- OVERVIEW OF INSURANCE

- CONTRACT MANAGEMENT

- DOCUMENTATION

- APPLICATION SIGNPOST

- INBOX FOR COMMUNICATION

At first glance, they look the same, but the difference between them is huge, and so are their benefits to your organisation. We’re talking about websites and portals!

While a website focuses only on the one-way delivery of information without restrictions, a portal is a comprehensive content management system that provides an organization with a space to capture, share, exchange and reuse information from its users. The content of a web portal is dynamic and is collected from a variety of sources. It can be limited to a specific group of users who are authorized to do certain actions online. In addition, the visibility of the content may be unique based on the settings of the group members.

Portal solutions are used to integrate different applications under one roof. From a single location and within a single infrastructure, a portal provides information to users based on their level of access, provides comfort and increases work efficiency.

In 18 years of developing applications and portal solutions, we have chosen the best – the Liferay portal. We value its strengths in the technology area: Liferay is an open, fast-developing platform supporting technology standards that streamline the implementation of our clients’ demanding requirements. In the business area, our clients appreciate efficient investments and low operating costs.

Public Website

The basic idea was to create a website that would be oriented toward the customer and their needs. In 2014, we created a solution based on the Liferay CE platform, which brought the following advantages for the client as an editor: a great variability of content updates, an advanced tool for creating contact forms and easy management and updating of data in the branch map. The average number of visitors to the Public Website of ČSOB Pojišťovna is 40,000 pageviews per week.

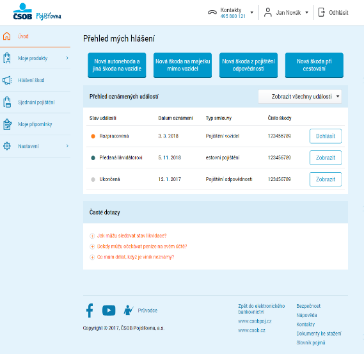

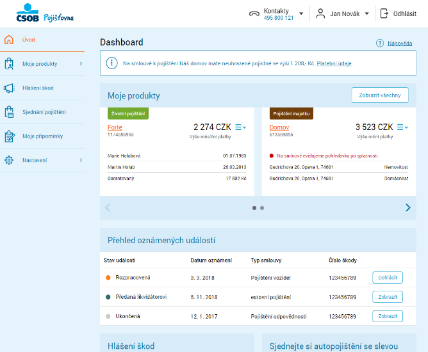

Client zone

The aim of the project was to create a portal for clients to return to, for more than just their contracts. The creation of a self-service client zone also met expectations and significantly reduced the call centre workload. An initial module with an overview of the contracts was launched in 2017 and we are still working on the development of others.

NEGOTIATION APPLICATIONS

- TRAVEL INSURANCE

- PROPERTY INSURANCE

- VEHICLE INSURANCE

- LIABILITY INSURANCE

- CYBER RISK INSURANCE

- MORE

Modern times require the constant availability of up-to-date information and services online. Web applications are often a key source of information that can be accessed at any time and from anywhere. They can be updated and managed without the need to install software on the devices of potential clients.

Web applications are able to facilitate any online business process from product/service selection and parameter setting, to payment or contract generation and signing. With a well-designed web application, you will be closer to your clients, reduce the business process to a minimum and increase your potential.

For example, our applications allow you to arrange insurance and report a claim online. Quickly, securely and without unnecessary costs.

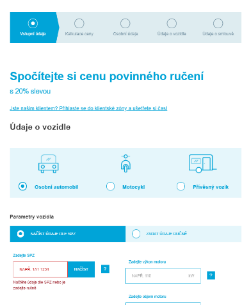

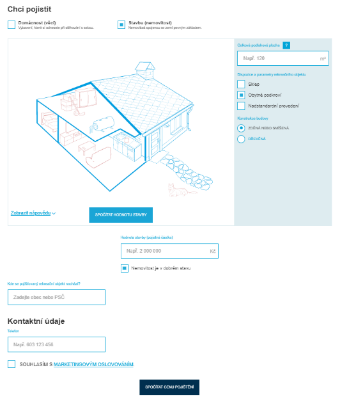

Negotiation applications

Since 2015, we have developed a number of negotiation applications to facilitate the entire business process of arranging insurance online, i.e., to show the client the price from the most necessary information for the calculation, which is further specified in the application. The client is immediately provided with a draft of an insurance policy, which can be paid for by payment card online. The personal data of logged-in users of the client zone are automatically filled in.

Provided applications:

- Travel insurance (2015)

- Internet risk insurance (2016)

- RENTO driver accident insurance (2016)

- Property insurance (2017)

- Vehicle insurance (2017)

- Liability insurance (2018)

CLAIMS REPORTING APPLICATION

- TRAFFIC ACCIDENTS

- PROPERTY INSURANCE

- LIABILITY INSURANCE

- TRAVEL INSURANCE

- MORE

Modern times require the constant availability of up-to-date information and services online. Web applications are often a key source of information that can be accessed at any time and from anywhere. They can be updated and managed without the need to install software on the devices of potential clients.

Web applications are able to facilitate any online business process from product/service selection and parameter setting, to payment or contract generation and signing. With a well-designed web application, you will be closer to your clients, reduce the business process to a minimum and increase your potential.

For example, our applications allow you to arrange insurance and report a claim online. Quickly, securely and without unnecessary costs.

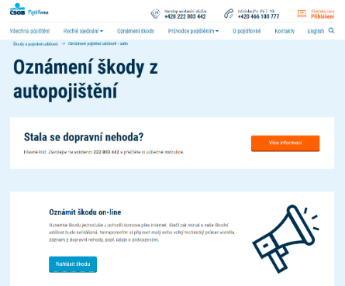

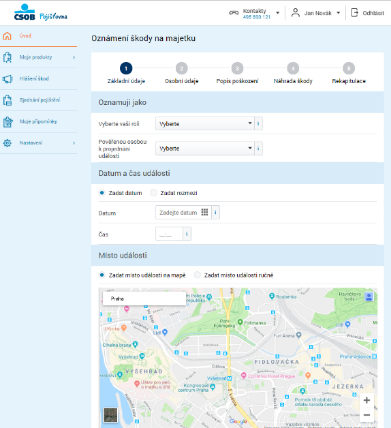

Application for reporting non-life insurance claims.

Preview: www.csobpoj.cz/skody-a-pojistne-udalosti

Implementation: 2019 – now

Description: The application allows you to report insurance claims online using forms to which you can attach documents necessary to investigate the claim. The application includes, for example, map components that can be used to easily mark the location of the accident or interactive images to indicate the extent of the damage. The client can see the status of their claims in the client zone. The personal data of logged-in users of the client zone are automatically filled in.

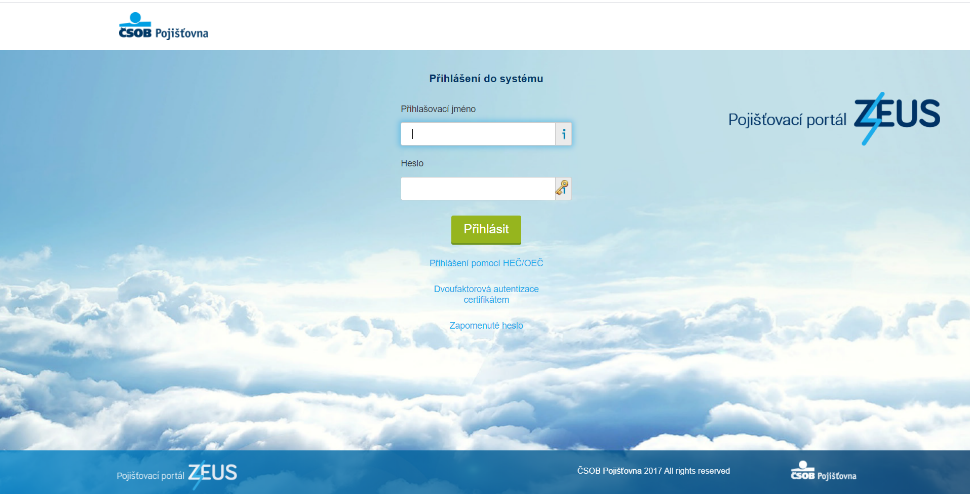

IDENTITY AND ACCESS MANAGEMENT

- CENTRAL AUTHENTICATION

- IDM

- SSO

Access Management is the process of securing information, or identifying, monitoring, controlling, and managing access to a system or application by authorized or designated users.

Authentication means protection against false identity. It is used in all business processes that require verification of the identity of a person, specific software, data messages, or another entity.

Any security, however, entails greater or lesser user comfort restrictions. With a combination of different login names, different password policies or requirements to change passwords at regular intervals, it is almost impossible for employees to remember all the relevant data.

Fortunately, there is also a solution for this: single sign-on, or SSO for short, which centralizes the user authentication process into one place - the so-called identity provider. The identity provider authenticates the user and then provides this information to other applications (also called service providers) that the user normally uses.

The user authenticates only once to the identity provider (SSO) at the beginning of his or her work. The user can then use the other applications normally without having to authenticate to them separately again. For target applications, in some cases, the user does not even need to know their user password, as the application itself trusts the data supplied by the identity provider.

At Cleverbee, we help your visions become reality. We build solutions that are an essential part of everyday processes and become stable pillars of any company.

We understand insurance company processes, and we can help you not only obtain clients, but also keep them.

Contact us

Did you not find the information you needed or do you have a question for us? We would appreciate it if you let us know.